As expected, 2010 turned out to be a fairly good year, considering that 2009 was a great one. The US market advanced 15% (in US dollar terms) and the Canadian market by 17.6%. Since the bottom of March 2009, North American stock markets have advanced on average 63%, to the disbelief of many doomsayers who were predicting the end of the American economic dominance.

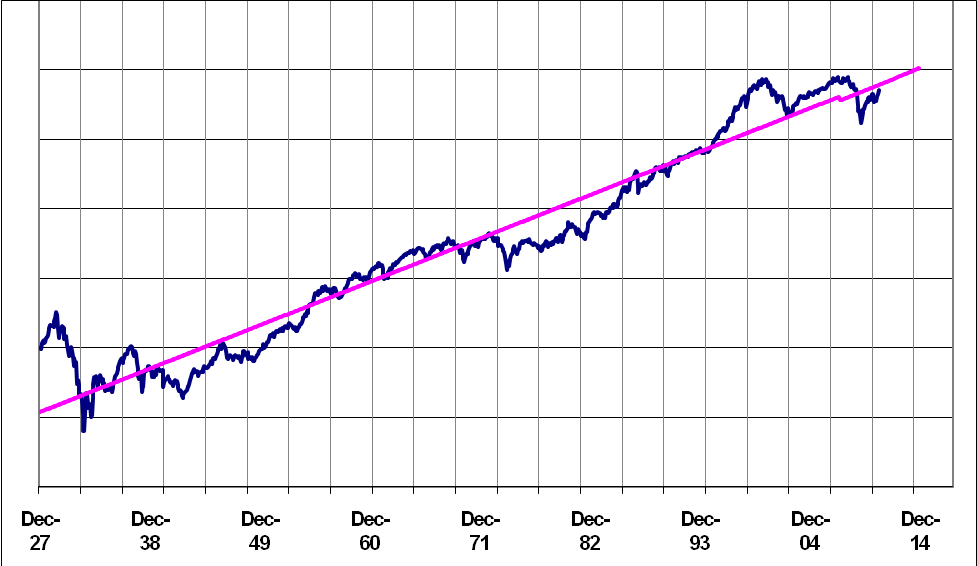

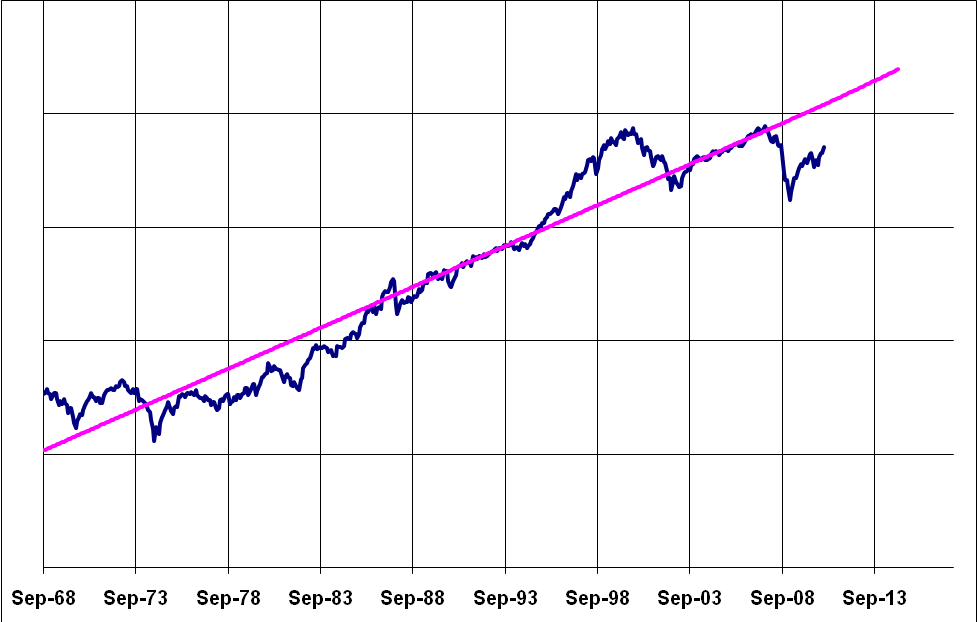

Let us give you an update of our long term chart on the S&P 500, one from 1927 to 2010 and the other from 1968 to 2010:

LONG TERM CHART ON S&P 500 (1927- 2010)

As you can see, the gap between the trend line and the actual level of the index has been narrowing. Using the chart above, the gap is only 100 points on the S&P 500. However, based on the shorter term chart (shown on next page), the gap is still 600 points.

In short, although we cannot say that the S&P 500 is cheap anymore, there is still room for the market to advance, especially if you consider the fact that in the 3rd year of a presidential cycle, markets rarely turn down.

Referring back to our last quarterly letter (October 2010) where we laid out a rough roadmap on the investing cycle, we have moved along and our guess now is that we are somewhere between phases 3 and 4. (For new clients, our previous letter is posted on our website)

SHORTER TERM CHART ON S&P 500 (1968- 2010)

Let us use this year-end letter to address several questions that our clients have sometimes raised:

1. “Should I deposit additional money into my investment account even when you (Claret) have not fully invested available funds?”

In order to answer this question, some notions on how we manage your accounts need to be clarified: As you should know by now, we try very hard to be as disciplined as we possibly can when choosing companies we would like to buy. We also try to avoid falling in love with any one stock by fixing a maximum level of exposure per stock. In general, each new position represents between 1% to 2% of your equity allocation (except for TFSA accounts). Consequently, if you happen to have cash sitting in your bank that you intend to invest in your portfolio, but decide not to send it to us because of the available funds in your investment account, the outcome is every position in your account will be underweighted since we cannot possibly know your aggregate liquidity position.

Some clients take the time to call us to let us know that they will be sending us more funds when the funds available in their accounts are fully deployed. Although we are very grateful for your confidence in our ability to manage your money, we can only manage your account based on what we actually see. Markets are unpredictable and because of all the behavioral biases we all have (especially us), we don’t want to end up with too few (and overweighed) positions, in case the funds you initially earmarked for your account at Claret become unavailable.

2. “What is your forecast for 2011”?

Although we enjoy sharing our insights for 2011 and beyond (mostly for entertainment purposes), we usually try very hard not to provide any detailed forecasting in writing. Why? The general answer is that we are no better than the average in their accuracy.

Before you think that there are better forecasters than us, let us give you some facts according to Ned Davis Research and “The Little Book of Behavioral Investing” by James Montier: From 1970 to 2010, professional economists did not predict a single one of the seven recessions that occurred within that period. In fact, they have never made a down year forecast for a period one-year ahead. Therefore, we should all be skeptical that forecasters will correctly predict getting out of stocks before the next recession. On average, equity analysts who first make a forecast of a company’s earnings 2 years prior to the actual event are wrong by a staggering 94 percent! Even with a smaller 12-month time horizon, they are wrong by about 45%. When looking at 5-year growth rate forecasts, the outcome is even more depressing: earnings that are expected to grow the fastest actually grew no faster than those expected to grow the slowest! Market analysts (they call them strategists on Wall Street and Bay Street) do not fare any better: in 2000, the average forecast for stock prices was an increase of 37% when the actual outcome was 16%. In 2008, strategists forecasted a 24% price increase when the actual number was -40%. In fact, between 2000 and 2008, this group of analysts hadn’t even managed to get the direction of the price change right in four out of nine years (barely 50% accuracy for the direction!!!). To add insult to injury, our experience has shown that whenever a group of forecasters make a unanimous call on an outcome, that outcome rarely happens.

The above brings to mind a somewhat amusing saying. If you are in the forecasting business, make sure you forecast often!

Fortunately, in the business of investment management, it makes no difference in the long run. Analysts are called analysts, not forecasters, for a reason: they are supposed to analyze, not forecast. It is supposed to be about understanding the business and its intrinsic worth, analyzing factors (fundamental, technical , behavioral etc) that could affect stock prices (up or down), back testing and deriving strategies from historical data, rather than spending time trying to guess the future.

Investment is about knowing where you are, even if you can’t know precisely where you are going. Knowing roughly where you are in terms of valuation and what that implies for the future is very different than predicting the timing, extent and shape of the coming move. The former can be done with knowledge and analysis while the latter is usually done with a Ouija board. To quote Ben Graham, “you don’t need to know a person’s exact weight to know whether he is overweight or underweight”.

The idea of investing without pretending to know the future gives us a very different perspective. Once we realize that forecasting is a waste of time, we can avoid the daily “noise” ever so prevalent on Wall Street and Bay Street. Instead, we can spend more time on things that really matter. Remember what Keynes said, ”You’d rather be vaguely right than precisely wrong”.

New development in Claret’s research

Quantitative modeling is an investment strategy that we, at Claret, have been developing over the last 3 years in order to add a new dimension to the portfolios we manage and improve our overall performance. Although it is not for everybody, the concept is quite interesting and the research behind it is quite extensive.

In short, quantitative analysis is basically the use of computers and mathematics to mine historical data in order to find profitable opportunities in the markets. Although the first research papers were written in the 50s, this subsection of finance only started in the 70s when astute investors began using computers in order to analyze market data. Until very recently, because of the high costs and complexities of running all these computers, quantitative methods were mostly used by institutions and hedge funds. The fast declining cost of computing power over the last 20 years has made these strategies accessible to everybody.

We basically program into computers our knowledge regarding stock valuation criteria and ask the computers to screen the universe of tradable stocks to find suitable candidates with which we would create theoretical portfolios. We then ask the computers to rerun the same programs at a later date, find new candidates and rebalance the portfolios. We then back tested these strategies in order to find out whether they added value to our portfolio management methods, both in terms of diversification, risk and return.

Obviously, we discovered that these quantitative strategies did add value, otherwise we would not have written about them! For those of you who are curious and want to know more about these strategies, we strongly encourage you to talk with your portfolio manager.

Have a Happy, Healthy and Prosperous Year of 2011.

The Claret Team