Energy and mining stocks are underperforming

After a three and a half year run from the bottom in October 2002, the stock market finally decided to take a breather. A correction

Every three months, the partners and portfolio managers collaborate on a summary of the state of the economic world as it pertains to your portfolio and our approach. Below, you will find links to our archives.

After a three and a half year run from the bottom in October 2002, the stock market finally decided to take a breather. A correction

Most markets have moved up nicely in the first 3 months of 2006. Resources and metals continue to lead the bandwagon with oil prices breaking

As in 2004, this year has again been labelled a “year of the commodities” but with a lot more strength in stock prices, reflecting the

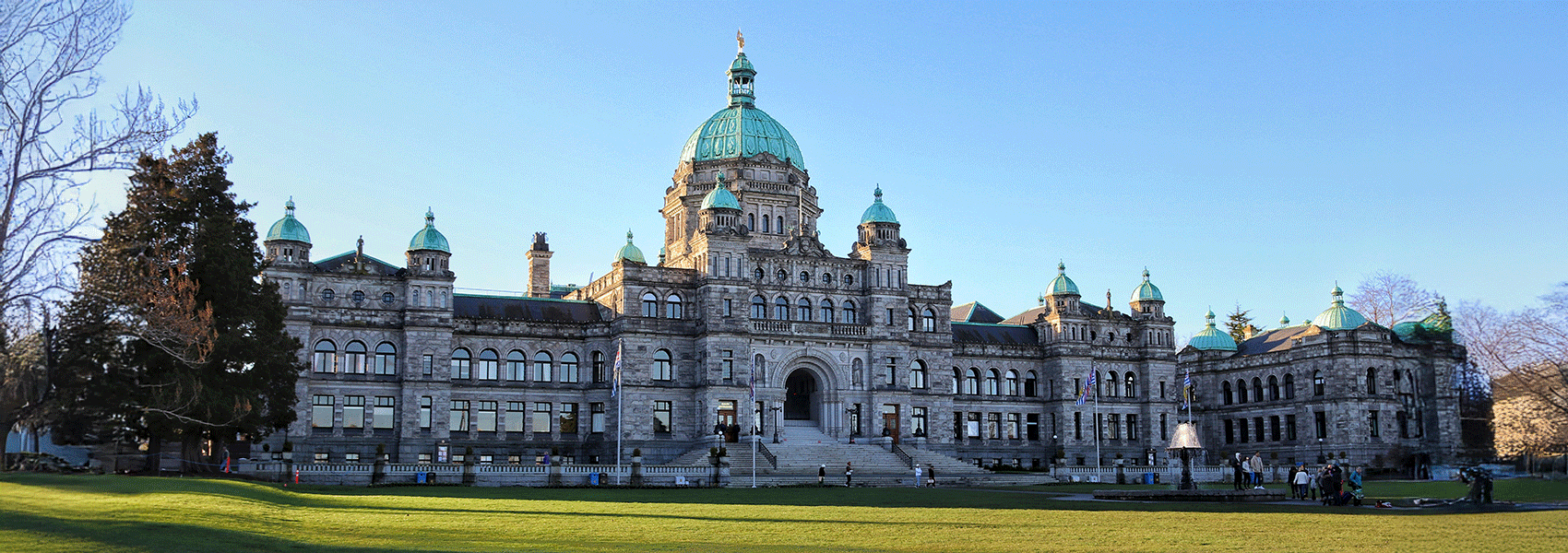

The Canadian stock market has been the superstar among the G7 countries, having outperformed most major indices by a wide margin. As you have probably

The Canadian market continues to outperform all major markets, having advanced a little over 7% in the first 6 months of the year versus slight

Except for the Canadian market, which is mainly driven by the surge in commodities prices, the 1st quarter of 2005 did not produce any gain

2004 has definitely been the year of the commodities. Energy, base metals and other raw materials prices have all gone up tremendously. Therefore, resources based

Today’s investors have access to more products than ever. Among the most common are Mutual Funds, Exchange-Traded Funds (ETFs), and stocks. Each option can help

Saving isn’t glamorous. It means choosing to withhold spending now so you can enjoy more in the future, and let’s be honest: in your 30s,

At first glance, implementing tariffs may seem like a straightforward and beneficial policy. After all, why not impose a tax on foreign goods and generate

Fixed income indexing is a passive investment approach that aims to replicate the performance of a bond index by holding a diversified portfolio of fixed-income