Remember when General Electric was the largest public company by market capitalization in the United States? Its downfall–caused by poor management, the 2008 financial crisis and bad investments–marked the end of an era. Fast-forward to today and GE has split into three separate businesses. As of January 1st, 2025, Apple holds the crown as the largest public company by market capitalization. But for how long?

To explore this question, we will examine the evolution of the top three companies by market capitalization in the United States since 1996, using data points recorded on January first of each year.

How Is Company Size Measured?

Between 1996 and 2024, 14 companies have been in the top three. But how exactly do we measure a company’s size? One widely used metric is market capitalization. For those unfamiliar with the concept, market capitalization is calculated by multiplying the number of a company’s fully diluted outstanding shares by its current stock price. For example, if Apple (NASDAQ: AAPL) had 15 billion shares trading at $245 per share, its market capitalization would have been $3.6 trillion.

This metric is important because, with all else being equal, a rising market capitalization indicates a positive stock return. It is also how companies are ranked on the S&P 500.

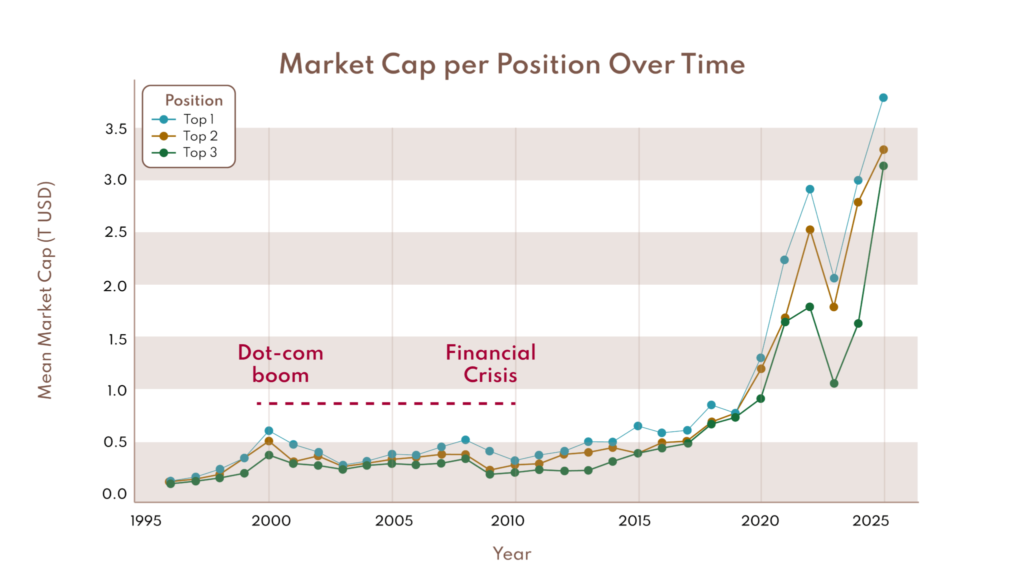

From this graph, which shows the Top 3 Companies by Market Cap over time, we can observe a few things:

- From the peak of the internet bubble in 2000 to the Great Financial Crisis in 2008, the market capitalization of the largest companies saw little to no growth.

- A significant rally began in 2009 and continued to 2024, with a slight correction in 2022.

Top S&P 500 Companies by Market Cap (1996-2025)

To better understand this, let’s divide the timeline into two periods: 1996-2009 and 2010-2024. Who were the key players? Between 1996 and 2009, companies from various sectors dominated the top three, including:

- Coca-Cola (consumer goods)

- Exxon Mobil (energy)

- Microsoft Corp (technology)

- General Electric (industrial)

- Walmart (retail)

- Pfizer (healthcare)

All of these companies are still active today. However, starting in 2016, we saw a shift: all the companies are from the tech sector. What stands out is Microsoft’s longevity, which has been in the top 3 for an impressive 24 years.

This metric is important because, with all else being equal, a rising market capitalization indicates a positive stock return. It is also how companies are ranked on the S&P 500.

What About Investing?

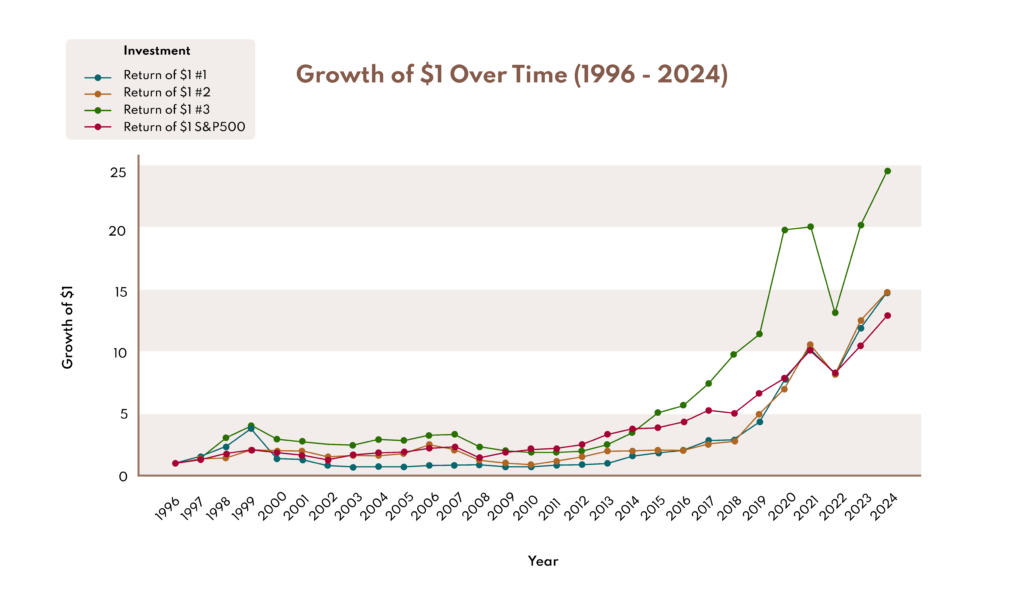

Would rotating into the top three companies at the start of each year have produced better returns compared to the S&P 500?

To answer this, let’s see the growth of one dollar:

The largest company often underperforms, while the third largest tends to outperform its peers and even the S&P 500. This pattern underscores the idea that today’s giants were yesterday’s small businesses, with innovation and adaptability fuelling their rise to dominance.

However, caution is warranted. One dollar invested in the largest company of 2000, Microsoft, would not have yielded positive results until 2014. This highlights that buying the biggest does not guarantee positive returns, as factors such as valuation or sector rotation can impact performance.

The Takeaway

Bigger doesn’t always mean better, and change is inevitable. The largest companies are dethroned from the top spot, but their influence endures. Remember Intel, Cisco and Pfizer among others. As history has shown, today’s market leaders may not hold their positions forever, but their legacies continue to shape their respective industries.