It seems to us that markets have started their correction and will probably stay quite choppy until the fall. After an 87% increase from the bottom in March of 2009 for the S&P 500, it would not be difficult for any investor to expect some sort of meaningful correction.

However, our road map stays the same: equities will outperform bonds over the long term, especially when interest rates are at historical low levels. Moreover, as we have repeated many times over the last several quarters, asset allocation is the most important aspect of your investment strategy because it helps you determine your level of comfort regardless of the fluctuations inherent in equity markets. Please note that we are talking about fluctuations in market prices and not risk. We believe the two are very different from each other.

With European economic uncertainty, the PIIGS countries in economic turmoil (Portugal, Italy, Ireland, Greece and Spain) and the US in not much better shape, many investors wonder whether it is still worth the risk to stay invested in equities. Reading newspapers, listening to the TV and surfing the Internet exacerbates this feeling. We would not be exaggerating by saying that the whole wide world knows that we have a problem. If you don’t believe us, survey your friends and ask them what they think about the state of the global economy. We would not be surprised at all if this was their response:

- The US debt is out of control and it will tank the economy;

- Greece is going bankrupt;

- The US real estate bubble will burst again, this time led by commercial loans;

- Unemployment will stay high and that is bad for the economy;

- There is going to be a double-dip recession.

We don’t know whether any of these comments will come true nor do we know what impact they will have on the equity markets if some of these responses do in fact occur. However, we do know some sound principles:

- It is next to impossible to get in the market at the bottom and get out at the top. After decades of research, most analysts are still looking for the Holy Grail. One thing is for sure: we can tell you that one or a small group of market forecasters will get it right, just like we can tell you that on average that one or a group of people will win the 6/49 lottery every week . We just don’t know who this person or group of people is beforehand.

- For those of you curious enough, we highly suggest you look back when the stock market hit its low of March 2009 and reread the newspapers then. If the news in today’s newspapers gives you cause for reflection about equity investing, we can assume that back in March 2009 you would have put your money under the mattress since the news at that time was atrocious. Leaving your money under the mattress would have been a big mistake as the market staged one of its biggest rallies in history. All this to point out that markets in general and the economy are nearly never in sync, with markets tending to lead, sometimes incorrectly but most of the time correctly, an economic recovery. As the famous economist Keynes said humorously: “successful investing is anticipating the anticipations of others”.

- Investing requires a deep analysis of one’s personality and one’s perception of what greed, fear and risk is. For example:

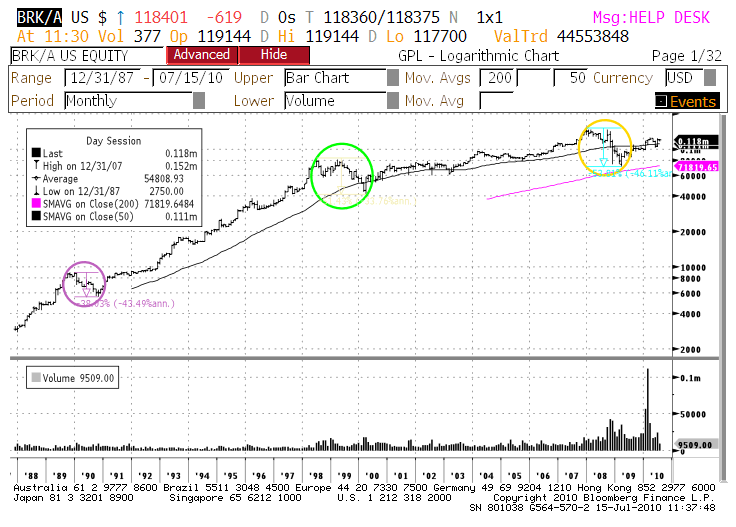

The following chart shows the long term performance (since 12/31/1987) of one of the best known stocks in America: Berkshire Hathaway Inc. with Warren Buffett at the helm.

- As you can see, the stock’s long term performance is outstanding: 17.91% annually, compounded compared to 8.82% for the S&P500. The stock price has increased from $3,000.00 a share to $118,000.00. The ultimate question to ask is whether you could have held on to this stock for 30 years. Our experience tells us that most investors would say: “piece of cake”, or “of course I can” or something similar.

- Independently, if we were to ask the same investor whether he/she could sustain a 40-50% paper loss in his/her investment at any given period of time, the answer would have been: “that is too much “or “I don’t want that wide of a fluctuation” or something along these lines.

Unfortunately, both points 1 and 2 are pretty much linked: the 3 circles on the chart show periods where the average drop in value was around 48% (precisely 39%, 51% and 54%).

Our take is the following: Point 1 is driven by greed while Point 2 is driven by fear. With hindsight (i.e. known results), investors come to a seemingly very rational conclusion that they have no problem with the fluctuations. They do not perceive them as risks. However, when they face uncertainty looking forward, then fear takes over and they perceive the fluctuations as risks.

We can show you thousands of examples and the results are always the same. Our brain deals with the past and known situations very differently from an uncertain, future one. Consequently, it is very important to design a strategy and to choose an asset allocation that fits your emotional make-up regarding these 3 factors, being greed, fear and risk.

- Most investors believe that forecasting the future is the most important factor in successful investing. It would certainly be wonderful if you had clear foresight, in which case you certainly would not need any help from anybody and would be surrounded with people seeking your advice. Unfortunately, we have yet to find a forecaster who has made piles of money by consistently predicting future market movements. Although some do get very rich writing forecasting newsletters. Short of having a crystal ball, discipline is the most important factor in investing, followed closely by objective analysis and valuation.

As always, we welcome your comments and questions at all times and we will try to address them in the next quarterly letter. We wish you a pleasant summer.

The Claret Team